What is it?

Is your firm currently requiring tenants to purchase renter's insurance coverage? Typically, property owners and managers partner with third-party companies to provide or monitor tenant's insurance policies. However, we have a superior solution for you – MAFS.

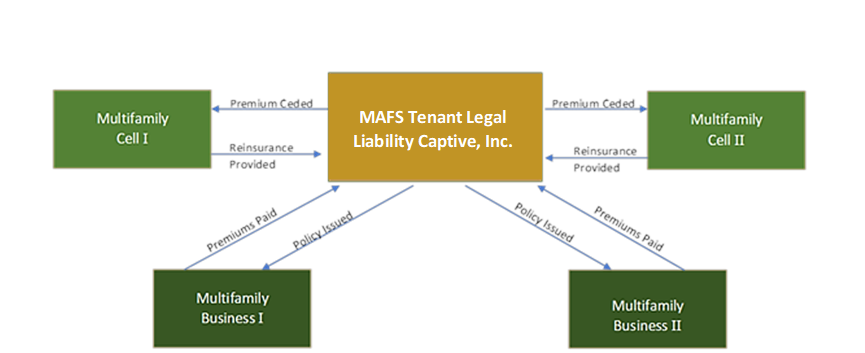

MAFS is a cutting-edge Protective Cell Company (PCC) legal liability captive insurance program designed explicitly for property owners and managers. Our program allows you to tap into the underwriting profits that have traditionally been exclusive to insurance carriers.

Our program offers property owners a comprehensive $100,000 coverage limit for property damage caused by tenants, including incidents such as fire, smoke, explosion, water damage, sewer backup, drain or sump overflow, sprinkler leakage, freezing of plumbing, heating or air conditioning systems, appliance discharge or overflow, weight of tenant contents, riot or civil commotion, and building collapse resulting from the above events. Additionally, an optional $50,000 limit for tenant property coverage is available upon request.

With no deductible and the potential for significant profit generation, MAFS is an invaluable opportunity for property owners looking to optimize their insurance strategy. Choose MAFS to protect your investment and benefit from a smarter, more profitable insurance solution.

How Does it Work?

Picture a PCC captive as a honeycomb filled with individual cells. The sponsoring "parent" company sets up the captive (representing the honeycomb's main body), and each cell symbolizes a member business participating in the program's financial aspects. The parent company takes care of issuing insurance policies and managing the administrative elements of insurance, such as premium billing and claims processing. This configuration enables participants to benefit from the financial aspects of tenant liability programs while distributing risk across a broader group of companies, effectively mitigating the effects of any significant claims.

-

Step 1.

The Owner waives the insurance requirement in its Lease documents for new and renewal tenants and charges a flat monthly fee with rent.

-

Step 2.

The Owner uses the fee to pay premium into the Captive Program each month.

-

Step 3.

The Owner’s Cell Captive reinsures a share of the CORE, effectively capturing the profit derived from its share of the participating tenants.

-

Step 4.

Claims are paid prorata by both the PCC and CORE.

-

Step 5.

Revenue and expenses are accounted for in the PCC.

What are the typical returns?

Based on actuarial data, a 5,000 unit/bed portfolio would earn $515,000 per year in net profit by partnering with MAFS.

What Services Are Provided?

MAFS offers a streamlined program integration experience! We deliver:

Comprehensive lease reviews and state-specific legal recommendations

Efficient revenue collection and reporting processes

Expert training for property managers

Comprehensive handling of all claims

Choose MAFS for a seamless, all-in-one solution to elevate your property management experience.